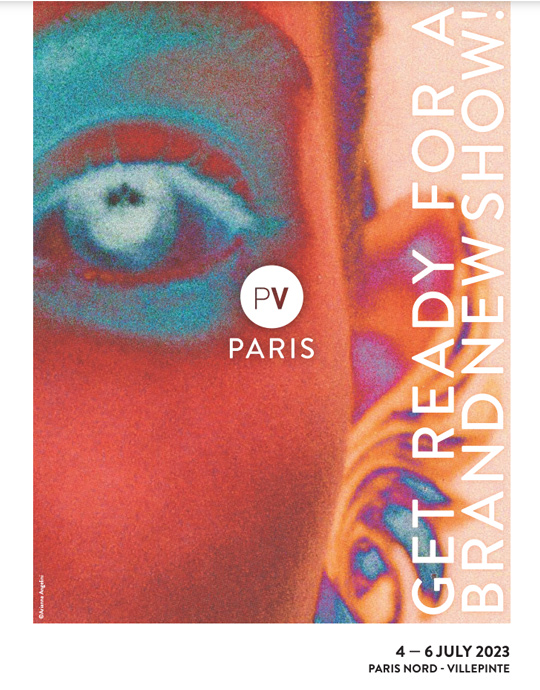

PV PARIS – SUSTAINABLE FASHION HITS ITS STRIDE

Published by Sugar & Cream, Tuesday 18 July 2023

Images courtesy of Premier Vision Paris (PV Paris)

July 4-6, 2023, Parc des Expositions de Paris Nord Villepinte

The fashion industry is on a journey towards ever-greater environmental responsibility. Having embarked on this path several years ago, its actions are now being noticed and its efforts recognized by consumers, whose buying habits increasingly take sustainability and quality into account. Here’s a look at the state of play.

A new study conducted by the IFM (Institut Français de la Mode)–Première Vision Chair, based on a panel of 5,000 respondents, offers a unique view of the progress of sustainable fashion. Five countries were surveyed: France, the United Kingdom, Germany, Italy and the United States. So, how do we view eco-responsible fashion and, more importantly, how does it affect our purchases?

Première Vision, a leading organizer of events for the creative fashion industry, is committed to providing guidance and education, in particular through its flagship show, Première Vision Paris (July 4-6, 2023, Parc des Expositions de Paris Nord Villepinte). During these international professional gatherings, Première Vision brings together all the players to encourage reflection and promote new ways of envisioning fashion.

The IFM-Première Vision study, conducted for the first time in 2019, provides us with information on the dynamics at work in terms of eco-responsibility and new evolutions, helping us guide the entire industry in understanding this new landscape.

LESSON 1: FASHION HAS BEEN HEARD

The first lesson to be drawn from this study is that fashion seems to have begun its eco-responsibility revolution in the eyes of the general public. Until recently perceived as one of the most polluting industries, its transformation has become more visible to consumers. Indicators confirm this: the strategy initiated years ago by the major luxury houses, then followed by the industry as a whole, is being more closely watched and better understood.

“The image of fashion is definitely improving. The efforts made by brands, especially in terms of information and transparency, are being noticed,” said Gildas Minvielle, Director of the IFM Economic Observatory.

This trend can be seen in several specific ways. In response to the question “Is the fashion industry more or less respectful of environmental criteria than other sectors?” 64.3% of French respondents said that it was just as respectful or more respectful. That’s six points more than three years ago, when the glamorous side of fashion seemed to be at odds with consumers’ environmental concerns. This evolution can also be seen in Germany (67.8%, +8 points) and reaches its highest levels in Italy and the United States, where 74.7% and 81.5% of respondents respectively consider fashion to be as environmentally friendly or more so than other industries.

What about their actual purchases? In a difficult economic context—clothing and textile sales have still not returned to their 2019 levels—the budget allocated to eco-responsible fashion is on the rise. It has risen from €136.5 to €148.6 per person per year in France and has even jumped in Germany (from €148 to €212) and in the United States (from $171 to $230).

However, “green” clothing still has a long way to go before it becomes as much a part of our shopping habits as other types of products. For example, while 68% of women (with men following the same trend) bought organic food and 63% bought organic cosmetics in the last year, only 44.9% of French people said they had chosen eco-responsible clothing. This is more than in the UK (42%) but less than in Italy (54.4%).

Presented by Melandas Indonesia

2. ECOLOGY AND BEAUTY GO HAND-IN-HAND

Underlying factors can explain the rise of sustainable fashion, starting with a heightened awareness of environmental issues. But style also matters. And there has been a shift in consumers’ minds: eco-responsible fashion is now perceived as being compatible with trends and elegance.

This is great news: the “green vs. beautiful” dichotomy, which has long prevailed, seems to be behind us. In the five countries surveyed, nine out of 10 people see sustainable products as fashionable, up eight points in France and 13 points in Germany since 2019. “These are remarkable results,” said Gildas Minvielle “We are now very close to consensus.” The change initiated by a few luxury brands several years ago is catching on.

3. CONSUMERS ARE BETTER INFORMED

Just three years ago, a lack of information was cited as the main obstacle to buying eco-responsible clothing. Among non-buyers, more than one in two people in France (50.4%) said their reason for not buying eco-responsible clothing was that they did not know enough about the issue. By 2022, the level of information among the French public had risen sharply and this figure had fallen to 33%.

The number of consumers who consider themselves well-informed has even doubled in some countries, rising from 18% to 36% in Germany and from 32% to 57% in the US.

In addition to greater awareness, consumers are also more likely to know where to find these products in their local stores. Proof that the industry is turning a corner in terms of transparency and has reached a higher level of maturity on these issues.

Among the channels of information preferred by customers, two sources stand out. The first one is the garment label itself, which is by far the most popular information channel in all the countries surveyed: over 70% in France and between 60% and 70% in all the other markets. It is followed by information given directly at the point of sale. Other sources of information, such as the brand’s website, media or social networks, lag far behind.

4. THREE DYNAMICS CALL FOR BETTER QUALITY

In 2022, consumers consider materials to be very important. They are looking for materials that can be viewed as eco-responsible (natural or otherwise), recycled materials, and high-quality manufacturing, free of toxic products.

The importance of materials is reinforced by three powerful dynamics:

1. Durability: buy less often, and keep items longer. The search for clothes that last is growing. As a result, more attention is being paid to the materials from which they are made and their quality, which directly impacts a product’s durability. This quest for durability aligns with the quest for responsibility, which is still very closely linked to materials in the public’s view (in France, 37.7% of respondents cite materials as the first metric for eco-responsibility).

2. Repairability: a surprisingly widespread phenomenon. The idea of repairing clothes or having them repaired is spreading rapidly. In 2022, no less than 64.2% of French respondents said they had repaired at least one item of clothing. The figure is even more spectacular in Italy, where it reaches 82.4%. Offered by certain brands and even new companies dedicated to this service, the trend towards reparability is anything but anecdotal. Clothing joins other sectors where this trend can be seen (furniture, household appliances, decoration, etc.).

3. Second-hand: the global second-hand market has boomed, and keeps growing. About one in two women and one in three men bought a second-hand item last year, a rate that continues to rise. Though they used to owe their popularity to the fact that they were less expensive, second-hand items are now chosen for other reasons, too. Although still in the first place, price is less frequently cited as a reason for purchase (68.6% of French people, versus 74.8% three years earlier), while the environmental credentials of second-hand are gaining ground (48% of French people, compared to 43%). Like with durability and repairability, the explosion of the second-hand sector demands good quality garments that can live several lives.

5. THE “MADE IN” COMPONENT KEEPS GROWING

Perceptions of environmental responsibility remain strongly correlated with the geographic proximity of production sites. To be considered sustainable, a garment must be made close to home for an overwhelming majority of French people (82.3%), for 79% of respondents in Italy, and for 85% of Americans. “The definition of ‘locally made’ has expanded to include our European neighbors,” Gildas Minvielle explained. Nearly six out of 10 French people believe that a garment made in Europe also offers guarantees of environmental responsibility, an opinion that has increased by 13 points since 2019. But it’s still a long way from the most local production.

In the United States, this “regionalist” movement witnessed in Europe isn’t at all visible, while “localism” is at record levels. While 53% of consumers used to believe that a product made by their Central American neighbors could be considered responsible, today only 28% do.

6. A NEED FOR RELIABLE INFORMATION

Consumers want to keep the momentum going: they ask for clear and reliable information about how their clothes are made. In fact, while the proportion of consumers who feel they have enough information has doubled in recent years, it still only represents a third of the sample. Yet six out of 10 people in France say that better information would encourage them to buy more sustainable products.

Regulatory changes—whether national, European or American—are therefore anticipated by both shoppers and brands. Certification labels have a key role to play in guiding them. But their sheer number—there are now more than 400 eco-responsible labels—makes them difficult to understand. Of the 12 labels selected and presented to respondents, knowledge is unsurprisingly very heterogeneous. In France, only the EU Ecolabel stands out with 74% awareness. The others are recognized with difficulty.

To help the industry adapt to these new challenges, Première Vision is launching “‘a better way’: the sustainable programme for more transparent sourcing,” a solution that analyzes exhibitors’ initiatives and highlights their efforts to buyers and visitors. A specific pictogram guarantees verified commitments in five areas: social initiatives, production site impact, traceability, product composition, sustainability and end-of-life. 290 manufacturers are already eligible for ‘a better way,’ designed to simplify and guide a market that needs it.

CONCLUSION

The public’s growing awareness of environmental responsibility is undeniable. While the current challenging economic climate seemed to threaten the growth of the eco-responsible fashion market, it is holding up surprisingly well. The change in direction driven by brands has indeed borne fruit. The image of the fashion industry has shifted, and the coming years hold great promise for the brands that will educate, reassure and support their customers in choosing sustainable, well-made products.

184

02/05/2024

184

02/05/2024

THE IRRESISTIBLE CHARM OF BI RESIDENCE BY ALIGN (ALEXANDER GUNAWAN)

Di tangan Alex Gunawan (ALIGN), sebuah hunian bergaya modern tropis di Surabaya memancarkan pesona dengan sentuhan ethnic dan modern classic yang...

read more 98

02/05/2024

98

02/05/2024

ROH PRESENTS “O”, A SOLO EXHIBITION BY BAGUS PANDEGA

ROH presents ‘O’, a solo exhibition by artist Bagus Pandega from March 13 – April 28, 2024 featuring a new cycle of new and earlier artworks that...

read more 5.85K

30/04/2024

5.85K

30/04/2024

La-Z-Boy x The Garfield Movie

La-Z-Boy incorporated ups the Cat-itude with fun movie campaign to celebrate the release of The Garfield Movie in cinemas on 24th May 2024.

read more 2.03K

03/04/2024

2.03K

03/04/2024

THE 7TH EDITION OF ALCOVA MILANO – APRIL 15 - 21,2024

During Milan Design Week 2024, the 7th edition of Alcova Milano will take place at Villa Borsani and Villa Bagatti Valsecchi from April 15-21, 2024. Come...

read more 31.49K

16/05/2017

31.49K

16/05/2017

A Spellbinding Dwelling

Rumah milik desainer fashion Sally Koeswanto, The Dharmawangsa kreasi dari Alex Bayusaputro meraih penghargaan prestisius Silver A’ Design Award 2017.

read more 27.81K

20/09/2016

27.81K

20/09/2016

Thomas Elliott, Translating the Dreams of Spaces and Shapes

Selama hampir seperempat abad tinggal di Indonesia, simak perbincangan dengan arsitek dan desainer Thomas Elliott.

read more